Agriculture and Natural Resources

All classes of cattle have been setting price records in 2025, and they have shown little to no sign of slowing down or retracing their steps to a lower level. At the same time, many observers have compared the current price environment to the last price peak in 2014 and 2015. Thus, there is no time like the present to compare the two time periods and discuss the similarities and differences.

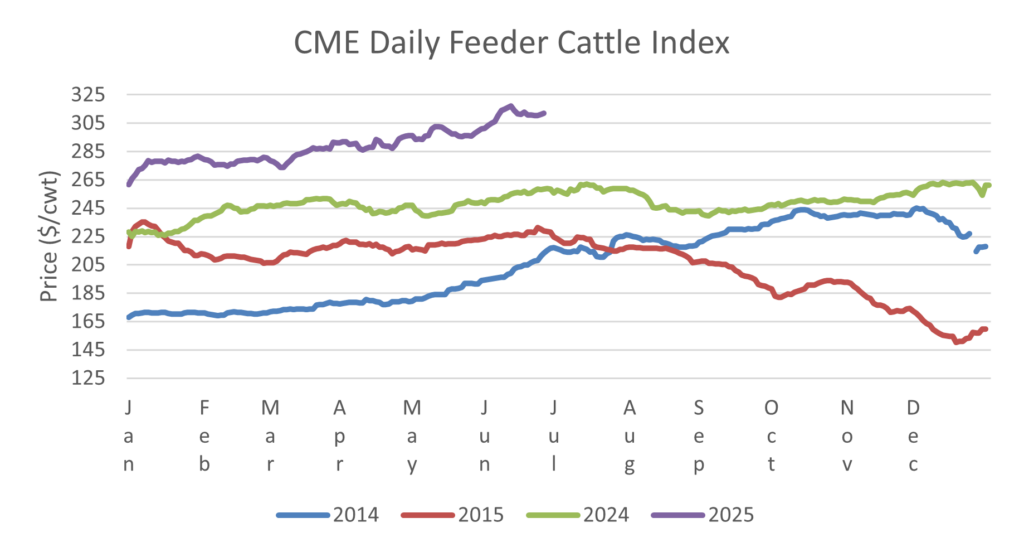

The figure included contains the daily CME Feeder cattle index values for 2014, 2015, 2024 and the first six months of 2025. For all the producers in 2014 and 2015 who said the market would never see these prices again, it is clear those prices reappeared much more quickly than expected. What has not yet occurred in the current price environment is the precipitous price decline that started the second half of 2015 and continued through 2016 and 2017. What is almost certain is prices will decline at some point, the magnitude and rate of decline is not known.

Looking at the price movement from a historical perspective, feeder cattle prices began increasing the latter part of 2013 when heifer retention was almost certain to begin. This resulted in feeder cattle prices increasing $77 per hundred weight during 2014. The price surge in 2014 was supported through the first half of 2015 before the feeder cattle index declined $85 per hundredweight from its high of the 2015 marketing year and $95 per hundredweight from the highs in 2014. This was then followed by several years of low cattle prices.

As the market continues to live through record prices across the cattle complex, one can only wonder and pontificate on how long prices will remain elevated and how quickly and to what level they will decline. To begin with, the feeder cattle index price in 2024 increased $38 per hundredweight from its daily low to its daily high. Similarly, the feeder cattle index has had a $55 price range the first six months of 2025, which means the feeder cattle index has increased $93 per hundredweight over the past 18 months, which is eerily similar to the 2014 and 2015 time period, which is about where the similarities conclude at this point.

The rapid decline in feeder cattle prices in 2015 followed a period of rapid heifer retention that technically started in late 2013, but then accelerated in 2014 and carried through 2019. The beginning of heifer retention during this time period pushed feeder cattle prices higher as fewer animals were available to place on feed, but it soon led to larger calf crops, which were evident in 2015 with 564,000 more calves than 2014 and more pronounced in 2016 when the calf crop grew nearly one million head from the previous year. By the time this is published, we will have an estimate for the 2025 calf crop, which should be smaller than 2024 at 33.5 million head. The question will be how many heifers producers retain this fall to begin growing the cow herd. The expectation will be increased heifer retention, which in turn should support calf and feeder cattle prices. However, history has proven that extremely aggressive heifer retention can send cattle prices spiraling at a rapid pace and a large magnitude.

This could be where the story ends, but there is one more important factor to mention and that is beef demand. Beef demand today far exceeds beef demand a decade ago. Using calculations from LMIC, the all fresh beef demand index in 2015 was 111, which was the highest demand index value since 2004. However, that same index was sitting at 128 for 2024. Thus, another supportive factor for cattle prices is strong beef demand.

There are similarities and differences when comparing the two latest price peaks in the cattle markets. However, one cannot be used to predict the other. It is clear times are “good” now, but prices will eventually decline. Producers should prepare themselves for the worst and hope for the best.